Today’s NEWS FEED

- SFLEX ซื้อหุ้นคืน 380,000 หุ้น รวมซื้อคืนแล้ว 17,263,100 หุ้น - 18:33 น.

- BPP ขายเงินลงทุนภายใต้โครงสร้าง Tokumei Kumiai (TK) โรงไฟฟ้าพลังงานแสงอาทิตย์ประเทศญี่ปุ่น 10 โครงการ รวม 91.69 เมกะวัตต์ มูลค่าราว 4,460 ล้านบาท - 18:31 น.

- YLG บทวิเคราะห์ทองคำภาคค่ำ ประจำวันที่ 16-06-25 - 18:14 น.

-

“Trip.com” เปิดบ้าน “ศูนย์บริการลูกค้า” ในไทยครั้งแรก! ชูบริการ “หัวใจไทย” พร้อมเทคล้ำสมัย ดูแลลูกค้าทั่วโลกตลอด 24 ชั่วโมง - 18:12 น.PR

- (แก้ไข) BWG มั่นใจ! เตรียมออกหุ้นกู้ 3 ปี ดอกเบี้ย 7.40% ตอบโจทย์นักลงทุน ชูวิสัยทัศน์ผู้นำจัดการขยะครบวงจร ขายสถาบัน-รายใหญ่ - 18:10 น.

-

AOT เคาะตั้งคณะกรรมการศึกษาแนวทางแก้ไขกรณีสัญญาร้านค้าปลอดอากร ยืนยันสถานะทางการเงินยังแข็งแรง - 17:29 น.PR

- PLAT เซ็นสัญญาเช่าที่ดินระยะยาวกับสำนักงานทรัพย์สินพระมหากษัตริย์ เพื่อการพัฒนาศูนย์การค้าและโรงแรม - 17:28 น.

- สรุปมูลค่าการซื้อขายตามกลุ่มนักลงทุน นลท.ต่างชาติขาย 3,530.45 ลบ.(SET) - 17:23 น.

- --สรุปมูลค่าการซื้อขายตามกลุ่มนักลงทุน นลท.ต่างชาติขาย 3,530.45 ลบ.(SET) - 17:23 น.

- VPO เผยบอร์ด มีมติ เป็นเอกฉันท์ ให้ยุติการดำเนินการเพื่อขอสัมปทานใหม่ ในการใช้พื้นที่ป่าสงวนเดิมของบริษัทฯ - 17:22 น.

-

กรุงไทยเปิดตัว “WealthFolio” ฟีเจอร์ที่รวมข้อมูลสินทรัพย์การลงทุนในที่เดียวบนแอปฯ Krungthai NEXT และ เป๋าตัง ยกระดับประสบการณ์บริหารความมั่งคั่งยุคดิจิทัล - 17:18 น.PR

- HotNews: SAMTEL วางกลยุทธ์หนุนธุรกิจเติบโตยั่งยืน ตั้งธงรายได้ปี 68 ทะลุ 6,500 ล้านบาท นิวไฮในรอบ 5 ปี - 16:53 น.

- วันนี้ดัชนีตลาดหุ้นไทยปิดที่ 1,114.49 จุด ลดลง 8.21 จุด หรือ 0.73 % มูลค่าการซื้อขาย 41,047.19 ล้านบาท - 16:48 น.

- วันนี้mai ปิดที่ระดับ 236.59 จุด ลดลง 0.55 จุด หรือ 0.23 % - 16:47 น.

- วันนี้SETWB ปิดที่ระดับ 542.43 จุด ลดลง 11.63 จุด หรือ 2.10% - 16:47 น.

- วันนี้SETESG ปิดที่ระดับ 703.14 จุด ลดลง 6.14 จุด หรือ 0.87% - 16:47 น.

- วันนี้SETCLMV ปิดที่ระดับ 573.05 จุด ลดลง 7.69 จุด หรือ 1.32 % - 16:46 น.

- วันนี้sSET ปิดที่ระดับ 567.73 จุด ลดลง 7.38 จุด หรือ 1.28 % - 16:45 น.

- วันนี้SET100 ปิดที่ระดับ 1,548.80 จุด ลดลง 11.18 จุด หรือ 0.72 % - 16:44 น.

- วันนี้SET50 ปิดที่ระดับ 725.71 จุด ลดลง 4.56 จุด หรือ 0.62 % - 16:44 น.

News Feed

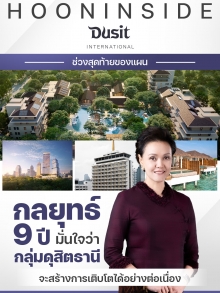

บล.กรุงศรี พัฒนสิน : CENTEL แนะนำ Buy ราคาพื้นฐาน ที่ 47.00 บ.

เนื้อหาที่เกี่ยวข้อง

บทความล่าสุด

HotNews: SAMTEL วางกลยุทธ์หนุนธุรกิจเติบโตยั่งยืน ตั้งธงรายได้ปี 68 ทะลุ 6,500 ล้านบาท นิวไฮในรอบ 5 ปี

ไม่มีปัจจัยบวก By: แม่มดน้อย

แม่มดน้อย ขี่ไม้กวาดวิเศษ นอกจากสงครามการค้า ปัจจัยที่มีผลต่อตลาดทั่วโลกในตอนนี้ นั่นคือ อิสราเอล-อิหร่าน ยังโจมตีตอบ...

มัลติมีเดีย

รู้จักพร้อมเปิดพื้นฐาน NUT ก่อนเทรด 11 มิ.ย.- สายตรงอินไซด์ - 9 มิ.ย.68

รู้จักพร้อมเปิดพื้นฐาน NUT ก่อนเทรด 11 มิ.ย.- สายตรงอินไซด์ - 9 มิ.ย.68